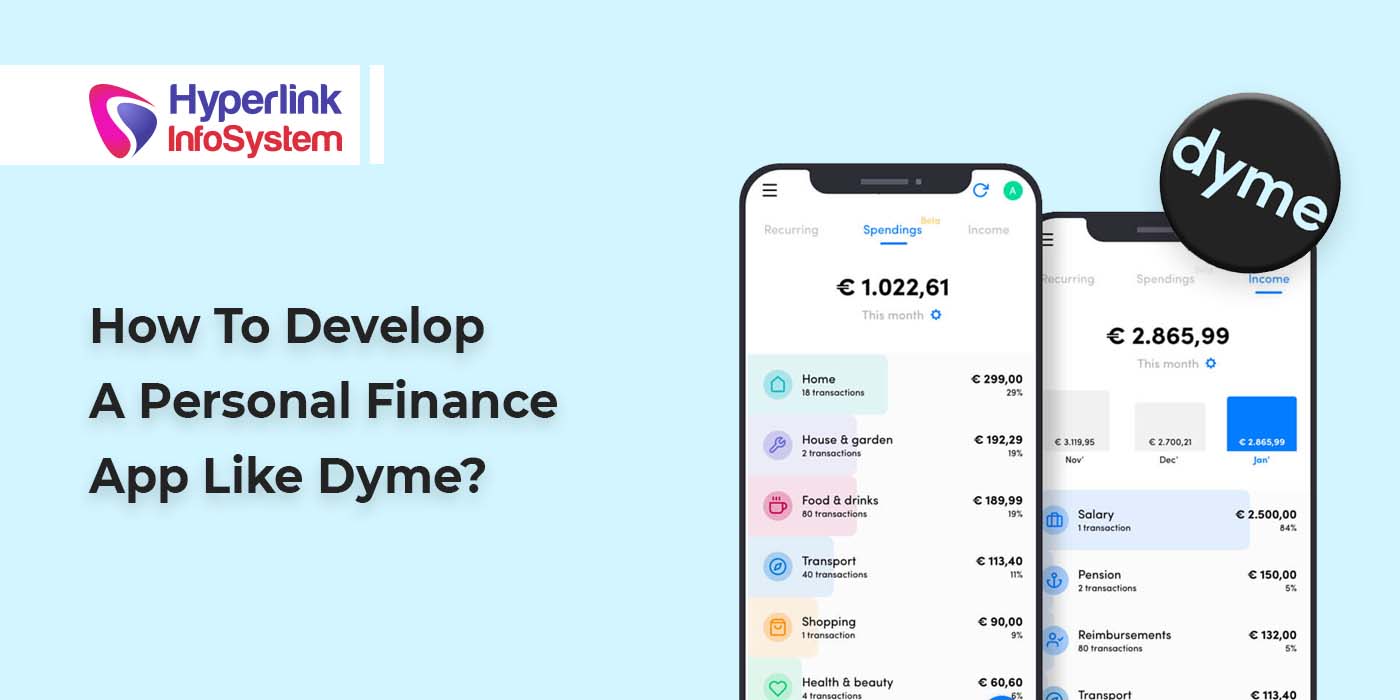

In an era where financial management is increasingly becoming digitalized, the

demand for personal finance apps is soaring. One notable player in this domain is Dyme, setting the bar high with its innovative features and user-friendly interface.

If you're intrigued by the success of Dyme and eager to tap into the flourishing market of personal finance apps, you're on the right track. As reported by Global News Wire, the current valuation of the personal finance management app market stands at $1.7 billion, and projections indicate a growth to $2.2 billion by the year 2027.

Recent studies reveal a remarkable 56% surge in downloads for the top 10 finance planning apps over the past five years, underscoring the immense profitability of personal finance app development.

In this ever-evolving landscape, understanding how to create personal finance app like Dyme opens up a world of possibilities, promising not only financial stability for users but also substantial gains for developers.

User Expectations from Personal Finance App

Monitoring Bills and Expenditures

Record your income and expenses effortlessly, either by manual input or through automatic tracking - combining both approaches provides an optimal solution. The app seamlessly integrates with banks and payment systems, offering a comprehensive overview of your financial information.

Despite these digital integrations, the flexibility to manually input transactions, especially those involving cash, remains a valuable feature. Notably, the app's cost classification feature proves highly beneficial, enabling users to associate expenses with predefined categories such as food, entertainment, utilities, and more.

This categorization enhances financial clarity, allowing users to discern and manage their spending patterns effectively.

Robust Security Measures and Adherence to Standards

Securing sensitive data is a paramount concern in any application, and it becomes even more critical in a budgeting app due to its direct access to users' financial accounts. A survey underscores that people are most apprehensive about losing control over their financial and banking data. Consequently, ensuring stringent security measures is imperative for a budgeting application. High-level security is not just a feature but a necessity to instill user confidence and safeguard their financial information effectively.

Seamless Integration with Financial Institutions and Payment Systems

A key advantage of a budgeting app lies in its capability to seamlessly connect all user accounts, consolidating and monitoring their finances in one centralized location. To achieve this, the budgeting application must robustly support integration with a diverse range of banks and payment systems.

Wallet Management

Organizing personal finances into distinct "wallets" constitutes a crucial aspect of effective budgeting. This method streamlines the assessment of financial capabilities over extended periods and diminishes the chances of impulsive expenditures. For example, you have the flexibility to establish various wallets, such as:

-

Moneybox

-

Current Budget

-

Loan Payment

-

Free Cash

This segmentation empowers users to allocate and monitor their funds with precision, fostering better financial planning and control.

AI-Enhanced Financial Guidance

By utilizing artificial intelligence, the app can provide comprehensive financial coaching information and customized advice on how to effectively manage spending and reach financial objectives. Additionally, AI technology enables automatic categorization of expenses, presenting users with a comprehensive overview of their spending patterns across different categories. This not only enhances the personalization of the finance app but also positions it at the forefront of the competitive landscape.

Steps To Develop a Personal Finance App Like Dyme

Step 1: Research

Conduct thorough market, technology, and business research to identify user needs, choose a development platform (such as Flutter), and define your app's unique selling proposition and revenue model.

Step 2: Strategize Requirements

Outline must-have features (e.g., subscription management, expense tracking) and consider advanced features (AI-driven insights, blockchain security) to differentiate your app in the market.

Step 3: Build Your Team

Hire dedicated app developers including, UI/UX designers, Fintech specialists, QA testers, and project managers. Consider hiring a reliable app development company for a complete and experienced crew.

Step 4: Crafting and Coding

Collaborate with your team to design user-friendly interfaces, leverage Flutter for responsive coding, and conduct rigorous testing to ensure a seamless user experience.

By following these steps and leveraging the expertise of a dedicated app development company, you can bring your personal finance app to life with efficiency and excellence.

Monetize Strategy For Personal Finance App

Monetizing personal finance management applications requires thoughtful strategies that align with user value and engagement. Here are effective monetization approaches:

Freemium Model:

Offer a free version of your app with basic features, and introduce a premium version with advanced functionalities. Users can upgrade for a more comprehensive financial management experience.

Subscription Plans:

Implement subscription-based models, providing users with various plans based on the depth of features or additional services. Monthly or yearly subscription fees can contribute to a steady revenue stream.

Ad-Based Revenue:

Integrate non-intrusive advertisements within the app. Ensure the ads are relevant to financial services or products, maintaining user engagement without compromising the user experience.

Partnerships and Sponsorships:

Form partnerships with financial institutions or other companies and earn revenue through sponsorships. This can include featuring specific products or services within the app in exchange for financial support.

Estimating Cost To Develop Personal Finance App Like Dyme

To embark on the development journey of a personal finance management app, like Dyme, hiring dedicated app developers or partnering with a mobile app development company is pivotal.

It's vital to grasp the financial commitment involved in its development. With an estimated development duration of 2000-2500 hours, the cost of developing a personal finance app typically falls within the range of $30,000 to $100,000, contingent on key factors.

Just hire app developers or a proficient mobile app development company, and ensure a focused and experienced team is devoted to your project, contributing to the efficient and successful creation of your personal finance app.

Conclusion

In conclusion, embarking on the journey to create personal finance app like Dyme demands careful planning, strategic thinking, and a keen understanding of user needs. With a comprehensive approach to development, coupled with a commitment to user experience, crafting a personal finance app like Dyme opens up exciting possibilities in the ever-evolving landscape of financial technology.

As the market continues to grow and users seek more innovative solutions for managing their finances, building an app that combines functionality, security, and user-centric design will undoubtedly pave the way for success in this dynamic industry.