Today, the most desirable trend in online business is the Buy Now Pay Later app. BNPL technologists are in the news for their increase in internet sales. It is a new idea yet a useful mobile app for common customers. Customers can open an account with a financial institution that will make purchases on their behalf. However, the customer is required to repay the money within a predetermined time limit.

Some merchants are currently looking for alternatives to the cash-on-delivery trend as well as ways to make the Buy Now Pay Later app more user-friendly for their customers.

These programs work in a relatively straightforward way: visit a store, purchase an item, select "buy now, pay later," pay a small fraction of the total amount owed, and then choose to pay the rest in installments. A credit/debit card or bank account can be used to make direct payments to the fund.

Tabby is a helpful app; You can

hire app developers from Hyperlink InfoSystem to build apps like Tabby. Hyperlink InfoSystem is a top mobile application development company. We will help you hire developers to create applications.

What is a Tabby App?

The buy now, pay later software is known as

Tabby. In 2020, the application was released. According to a report it has received over 1.5 million downloads in the last two years.

One of the most obvious benefits is the convenience of paying later. The best thing about these apps is that they are supported by the majority of online retailers, including but not limited to Shine, Amazon, and AliExpress.

Buy Now, Pay Later (BNPL) service provider Tabby operates in Dubai and serves Saudi Arabia and the UAE. Users of the platform can shop whenever they want and pay later. Many well-known stores have collaborated with Tabby, including H&M, IKEA, Sheen, Ali Express, Namshi, and many others. Tabby has grown to be the top BNPL service provider in UAE with over 400,000 active users and 3000 daily downloads.

Using Tabby, customers can get items delivered to their homes without paying the full price upfront. Customers can use the app to make purchases from physical and online retailers and avail of interest-free installment payments.

The app is now widely used by many organizations and consumers as it enables secure payment options without transaction glitches and fund processing delays.

These apps work simply. Now we will discuss how the Tabby application works.

How Does an App Like Tabby Work?

Tabby is one of the most well-liked fintech programs in Bahrain, Kuwait, Saudi Arabia, and the United Arab Emirates. Users can examine products in many product categories (including Fashion, Beauty, Home, Gifts & Gadgets, Baby & Toys,

Travel & Tourism, and Sports & Gaming) and browse their favorite brands on the well-known online shopping platform built by Tabby.

The program allows users to browse cashback deals from various companies, visit online stores, shop, and get attractive cashback from the seller. Well-known apps like Tabby provide effective payment services that are convenient, easy, and hassle-free.

The BNPL system is mostly used to make payments for short-ticket items over a short period, usually a period of 2 to 4 months. For the short term, no interest is charged on these payments. However, if you choose a longer term, interest may be charged.

For example, if your bill was $100, you could pay it off in four installments of $25, each with no interest charged. The traditional credit card sector has been affected by this system.

No additional interest charges are added to the account, but you will be charged a significant late fee if you miss a payment.

As more and more businesses partner with BNPL service applications, BNPL services are being widely adopted across the globe. According to research, WorldPay estimates that BNPL will account for $97 billion in total e-commerce sales this year. Users find that BNPL helps them manage their finances. BNPL applications have saved £103 million or $139 million in credit card debt in the UK alone.

BNPL applications use their own set of algorithms to assess a user's purchasing power instead of just the traditional credit score, so they allow even customers with low credit scores to use their services.

One way to describe a shopping trip is as follows:

Shop From Favorite Brands

Tabby has goods from over a hundred brands, from Adidas to IKEA. Consumers occasionally discover new companies and get the most out of their purchases.

Buy Now, Pay Later

The best aspect is the payment method that enables users to split the purchase into four interest-free installments.

Get Exclusive Discounts

Customers can avail of many exclusive offers and discounts from brands of their choice.

Handle The Payments

Customers can keep track of all their purchases in one place, including upcoming bills and updated payment options. They also receive notifications about upcoming payments.

After downloading the app, users can start shopping from Tabby. The complete process is described below:

-

The user registers for the app and then presents their Emirates ID to prove their identity.

-

After approval, the customer can make the purchase and select Tabby as the beneficiary during the checkout process.

-

The customer is then given a choice between a 14-day payment or four payments.

-

Tabby pays the merchant in full immediately after deducting the commission.

-

The customer will start paying the agreed amount to Tabby monthly after completing all the processes.

A Buy Now Pay Later Apps Like Tabby Offer The Best Features

To build an app like Tabby, one must be knowledgeable about all its aspects, from the most basic to the most complex.

Below is a list of features that have contributed to the app's record-breaking growth:

-

Login & Verification

-

Advanced Payment

-

Automatic Deductions

-

Security

-

Guest Feature

-

Management of accounts

-

Reminders

-

Featured stores

-

Cashback

We will explain the main features of the Buy Now Pay Later app one by one. So, let's take a deeper look at all the features below.

Login & Verification

The first essential but basic feature is safe and secure signup. Users should be able to register themselves on the app using their phone numbers. Ask users for their National Identification Number for security reasons. The application must complete the verification process only once they provide it.

Payment In Advance

Even when the due date has not passed, the app enables users to pay their bills in installments. The function is important to make the mobile application incredibly user-friendly.

Automated Deductions

The automatic deduction is another feature that helps the software reach its full potential. The functionality of automatic deductions can be manually enabled by users of the app, after which it will automatically deduct prices from the chosen card. Additionally, users can add additional cards and switch them as necessary.

Security

According to a report; The number of fraud operations in e-commerce increased by 30%, but at the same time, the sales increased by 16%. These figures show how crucial it is to incorporate security measures into e-commerce systems, especially for secure transactions.

The secret to protecting apps against hacker attacks and data loss is to incorporate strong and efficient security features. A secure and reliable buy-now-pay app is built by incorporating security measures like data encryption, two-factor authentication, and other laws.

Guest Appearance

Due to its user-friendly features, Tabby has a huge population. A guest feature is an example. Customers can use the app without creating and they can sign up later while processing their purchases.

Accounts Management

Customers often lose track of their past purchases and related information. By presenting the customer's account information, including their purchase history, payment dates, and other relevant data, the platform was able to fix this problem. As a result of its user-interface design, the app's popularity has increased tremendously.

Reminders

Reminders are the next crucial function of the BNPL app. Like push alerts, there are also reminders. The feature keeps customers properly informed about their upcoming bill payments and due dates, enabling them to pay on time and avoid overdrafts. The feature set successfully demonstrates its value by increasing the client's trust in the app.

Featured Traders

Integration of specialized segments or departments of featured retailers is another critical aspect of the BNPL application. The biggest brands that the app has partnered with are all highlighted through this built-in feature. The functionality simplifies navigation, eliminating the need to search for their preferred retailers.

Cashback

According to a Mozo study, 30% of BNPL app users make multiple purchases from the marketplace to earn points or cashback. Thus the cashback feature is another element for a flawless user experience.

Benefits Of Developing Tabby Clone Apps?

Fintech apps like Tabby have been more and more popular along with the rise in demand for buy now, pay later plans. The advantages of creating a Tabby clone app are listed below.

-

The software provides a simple and quick transaction facility.

-

The debt can be divided into four equal payments and paid off over time. For instance, your customers can pay in installments over a four-month period.

-

Increase client loyalty.

-

Improved sales for your brand as well as increased revenues result from retail stores partnering with such apps. A store that lets customers buy now and pay later will attract more and more customers.

-

It enables companies to improve brand loyalty.

-

Enhancing user experience by providing pay later option.

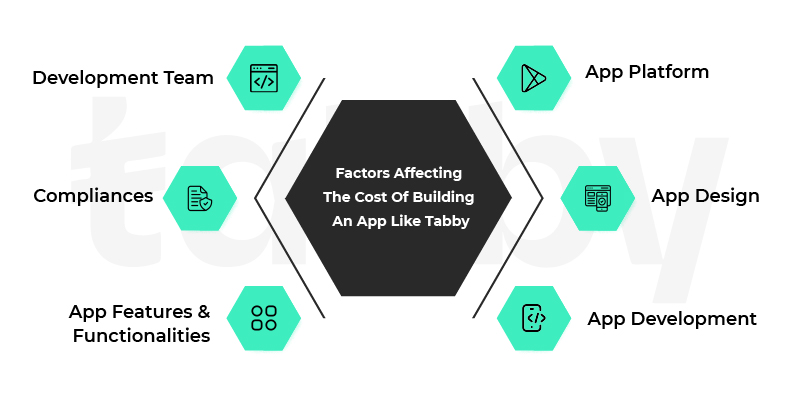

Factors Affecting The Cost Of Building An App Like Tabby

The concept behind the Tabby UAE app is to provide users with the option to purchase goods - either through the app or from a partner e-commerce merchant - and then pay for them over the course of four equal payments. But due to various components, Tabby's Buy Now Pay Later app is the most popular app in UAE. We are into mobile app development and can do this cost-effectively with our expert app developers.

Below are the various factors that influence how much it will cost to build an app like Tabby:

-

App platform

-

App design

-

App development

-

App Features And Functionalities

-

Compliances

-

Development team

Let's discuss in depth some of the key factors that affect the cost of developing a tabby app.

Application Platform

Different platforms will have different degrees of complexity. Some will require you to know how to code, while others can use a no-code approach.

app development costs are affected.

Application Design

The most notable advantage of the Tabby app is its straightforward design structure. The app is clearly divided into four screens: Shop, Payments, Cashback, and Profile. Each screen has a distinct user path represented by simple line symbols, uncluttered product images, and an intuitive user journey map.

Avoid crowding content and visual aspects when creating an app like Tabby to maintain a minimal feel. Consider the user path for each feature that will take them there before designing the structure.

Application Development

You have two choices when investing in pay-letter app development: either keep it specific to your business or build an API/SDK around it and make it easy to interface with other e-commerce stores. If you run an online store, Hyperlink InfoSystem suggests taking a milestone-wise approach, which means launching the functionality of your store before building an SDK or API.

The development work will focus on building the front and back end of the application, all the features we described above (or more), and integrating high-end technology like VR or AI for predictive analytics to try things out depending on the business model you choose.

Features & Functionality Of The App

There are numerous amenities available for tabbies. You can choose different features or functionalities depending on your needs. It will ultimately affect how much the project will cost to build.

Compliance

Regulatory compliance is still evolving globally as after-pay apps are still a relatively new idea in the financial sector. Reporting to the credit bureaus is a more compliance-related issue that you must deal with. Consumers' credit scores vary globally when they borrow money or make purchases on credit, depending on whether or not they repay the loan. If you want to keep this system under control then you will also need to report to the compliance bureau every week whether the customer has paid the EMI or not.

Team For Development

The team working on a Tabby app is the final element that dramatically affects how much it costs to build an app like Tabby. The size of the team and the field they work in are two factors in this.

The cost of building a buy-now-later application, however, also depends a lot on the region the team is from.

The cost of building an app like Tabby is determined by all these elements in addition to the functionalities mentioned above.

Cost Estimate For Developing An App Like Tabby

The cost of developing fintech apps varies from app to app. It also depends on who you choose to develop the app. The cost of hiring a professional development team may be higher compared to the lower cost of hiring inexperienced workers. If you're building a full app with lots of extra features, be prepared to pay more. Generally, the size of your mobile app, the features you include in it, and most crucially, the business you choose for the project all have a significant impact on the overall cost of app development.

Android and iOS mobile apps similar to Tabby app development cost between $5,000 and $30,000. This is assuming you maintain a medium-level complexity for the application. On the other hand, a full-featured or complete mobile app will be a bit expensive. The estimated cost of the development project is $10,000. There are fees associated with features like location tracking, chatting, and more. It is important to discuss the price beforehand with the mobile app development company so that you are aware of the full development cost. Keep in mind that the price also depends on the platform you choose to launch the app. You can create an app that runs on both iOS and Android devices or one that is targeted only to Android users.

Conclusion

As the global e-commerce wave spreads, consumers' interest in online shopping has changed thanks to the proliferation of smartphones and digitalization. The future of business is gradually but surely becoming to rely on models built around mobile experiences and solutions.

Therefore, we think that BNPL apps will transform shopping experiences and produce successful outcomes in the future. You can get in touch with Hyperlink InfoSystem to discuss developing a purchase now pay later app (BNPL app) if you want to be the proprietor of such apps.

According to analysis, the global BNPL market is expected to surpass the milestone of $20.4 billion by 2028 and surpass $1 trillion in yearly gross merchandise volume by 2025, both of which attest to this (GMV).

If you have any additional inquiries or would like to talk about business opportunities, You can hire app developers to develop apps like Tabby. As a

top mobile app development company, we build reliable and scalable applications for our clients.

You can get in touch with us for further details and a thorough grasp of the application development process.